Introduction

The Clutch platform provides developers with the ability to integrate through the JSON API.

This document will guide you through implementing a connection between the JSON API and your point of sale, website, shopping cart or any other service you might want to provide, where loyalty and/or gift functionality is being presented to your customer.

Loyalty

The Clutch loyalty engine does all the heavy lifting and computation, enabling your application to focus simply on recording checkouts, retrieving customer account information and redeeming rewards, among other actions.

At a high level, you will record checkouts into the Clutch platform, which will track all customer activity and perform actions specific to each customer, such as issuing rewards and sending notifications. You can choose to have rewards redeemed immediately in the form of calculated discounts, during the next checkout as a discount or you can place your own API calls to redeem balance whenever this fits into your process most optimally.

The business logic responsible for issuing points, giving discounts, etc is defined in Campaigns, which can be configured through the Clutch Portal.

Gift & Stored Value

In addition to loyalty services, the Clutch platform also provides the ability to manage gift, store credit, pre-paid or reloadable card services. You can issue or redeem balance for a customer using the API, as well as search for customers and perform balance inquiries. In addition, you can also reserve balance using ‘holds’ on any amount of card balance and use or release this hold later.

One card can hold any configurable number of balances at the same time. The same card could hold USD balance, but also Points and 'Coffee Points’ or any custom value type you want to set up.

Tools

There are a number of tools available alongside the JSON API that can help you get started and configure everything for your brand.

- Clutch Portal, allows you to configure almost everything for your brand. New features are continuously being added, but if you find something that you cannot configure through the Portal, our support team will be able to assist you.

- Virtual Terminal, this is a simplified online 'Point of Sale’ you can use to process transactions.

- Member Portal, depending on your brand setup, we can set up a member portal for you. In the member portal your customers can sign up with their card number and change their own demographics or link up with third parties, for instance linking their Twitter account to a card.

- JSON API, the actual API that you can call to programmatically execute transactions.

- Older APIs, not recommended to be used in new applications. Once you start using the JSON API, you should not be using the older APIs to access your brand’s data anymore.

Portal Access

Contact Clutch support to get access to the portal, you can contact asksupport@clutch.com to get started.

You will receive 2 logins, one for the stage portal where you can test everything out and one for the production portal, where all your real data will be configured:

- Stage portal: https://stage-portal.clutch.com

- Production portal: https://portal.clutch.com

Generating API Credentials

Internal (Clutch) Developers

Once you have access to the Portal, you can log in and generate an API Key / Secret pair, which you will need to place any API calls. If you are not a Clutch developer, you must contact asksupport@clutch.com.

To obtain a new API Key / Secret:

- Sign in to the Portal (stage or production, depending on where you want to use the API keys)

- In the left navigation, go to Admin > API Credentials

- In the top-right corner, press the green button for “New API Key”

- A pop-up will be displayed with the new API Key and the API Secret. Copy both of these now and retain them in a secure location, as the API Secret will get encrypted in the next step and will then be irretrievable for security reasons.

- Press the Save button, then the Close button.

External Developers

Contact asksupport@clutch.com for credentials to be issued to you

Sandbox access

Example request body for Search:

{

"filters": {}

}

Once you have your API Key and Secret, you will be ready to start testing out some API calls. When testing, make sure to keep these details on hand:

- Your API Key / Secret for stage or for production

- Your brand ID

- Your test location ID

- Your test terminal ID

You will receive your brand, location and terminal IDs from Clutch support once you get started. If you did not get them, contact asksupport@clutch.com.

There are 2 places to get started, either use the Sandbox at the bottom of this document, or use the Sandbox in the Portal.

Sandbox in this document

Go to the Sandbox in this document, it will explain how to use it.

Sandbox in the Portal

You can also use the sandbox in the Portal, which is a standard Swagger.io sandbox. To access it:

- Sign in to the Portal (stage or production, depending on where you want to test out your requests)

- In the left navigation, go to Documentation > JSON API Sandbox.

- Enter you API Key and Secret and hit the button.

- The lower area of your page should now be populated. You can expand this section by clicking on it and click on any of the API methods to try them out.

Definitions

Hierarchical overview of basic terms in Clutch.

- Brand

- Groups

- Portal logins (optionally restricted to location)

- Locations

- Terminals

- Employees

- Programs

- Value types

- Card sets

- Cards

- Card balances

- Customer demographics

- Coupon sets

- Coupons (unique at brand level)

- Campaigns

- Campaign rules

- Campaign rule conditions

- Campaign rule results

- Customer segment definitions

- API credentials

Brand

Your brand is the highest object in the hierarchy of definitions. You will typically have a single brand, and set up all your store locations, groups of store locations, employees, cards, etc under this brand. All objects within your brand belong strictly to that brand and can never be used outside of the brand.

Groups

Under your brand, you can set up any number of store location groups. By default, you will just have one group with all your store locations. However, if your brand has several subdivisions, you can choose to break up your store locations into multiple groups. Per location group, you can set up Clutch Portal logins with restricted access and get reports / statistics about all activity limited to the group’s store locations.

Portal logins

You can log in to the Clutch Portal for the production environment, or use the Clutch Stage Portal to get started in a test environment. A Portal login can be restricted to a group or a specific location.

Locations

A location represents either a physical brick and mortar store location, a website or anything describing a venue where customers can interact with a Point of Sale device.

Terminals

A Terminal object represents a Point of Sale device, used to indicate where an API call is originating from. In case of brick and mortar store locations, it would make sense to set up one Terminal object per physical Point of Sale device / cash register. For online environments, you would usually just set up a single Terminal object.

A Terminal object is always tied to one location.

Employees

An employee object represents an employee working at one specific location. You can specify an employee on every request and optionally require employees to use a PIN / password to perform any action through the JSON API. See the Employee Identification section for more information.

Programs

A program can be used to group one or more card sets, which in turn contain the individual cards. Per program you can configure some settings that you want to apply to all card sets associated with the program.

You can use a program as a logical grouping of multiple card sets that should all follow the same behaviour.

Value types

A value type is a description of a type of balance that is available to all cards of all card sets within one program. A value type is defined by its program, balanceType and depending on the balanceType optionally also a balanceCode.

Available balanceTypes are:

- Currency, in which case the balanceCode indicates which currency code the value type refers to

- Custom, in which case the balanceCode indicates which custom balance the value type refers to

- Points, no balanceCode is specified

- Punches, no balanceCode is specified

Per value type, you can configure the maximum balance you want any card to have of this value type and the minimum and maximum issuance and redemptions amounts. You can use this functionality to for instance limits gift cards in a specific program to have at most $100 on them.

You can set up Currency value types with international currency codes, such as USD. If the balanceType is custom, you can build out as many custom value types with custom balanceCodes as you want. You can use these custom value types to maintain balances specific to your brand, perhaps CoffeePoints or LifetimePoints. You can also use custom value types in combination with Campaigns to act as ‘counters’.

Card sets

A card set is a set of individual cards. If you have 10,000 physical giftcards, this could for instance be one card set. When placing a Card Allocation API method, you can allocate one card from a card set that you have set up.

In itself a card set does not have any configurable options, it mainly acts as a logical grouping of some cards.

Cards

Individual cards are the core object within the Clutch platform. You can use a card number to link customer data with, issue balances on it, or attach third party usernames to it.

One card can hold a multitude of balances, but at most one per value type that is configured for the program to which the card’s card set belongs.

A card always has a unique card number, which is what it’s identified with within the Clutch Platform. In addition, you can assign a custom card number to each card, which can then be used to search matching cards.

Card balances

Every card can have 0 or more card balances, at most one per value type set up for the program to which the card’s card set belongs.

Card balance can be configured to be expiring, it can be flagged as return-related balance (i.e. store credit) and you can place reservations on it.

Customer demographics

Every card can have a primary customer and even an alternate customer associate with it. On each of these customer objects, you can store some basic demographical data. For more information about saving demographical data on a card object, see Updating Card Information. You can also use a limited number of demographical fields from the primary customer object associated with a card to search matchhing cards. See the Searching Cards section for more information.

In addition to the basic demographical fields that are available, you can also store any custom card data you want on a card, see the Custom card data section for more information.

Coupon Sets

Coupon sets are groups of coupons that can be used to run promotions or discounts. It is possible to load coupon sets or autogenerate a set of coupons and coupon sets can optionally be expanded at a later point if it is depleted or getting close.

When allocating a new coupon for a customer, you have to select a coupon set to allocate from and a coupon will be picked from this set at random.

Coupons

A coupon is a one-time use object with a unique code (i.e. coupon ID). The coupon can optionally be restricted to only work with one or more cards and it can optionally be tagged with a set of tags. These tags can be defined both during the initial coupon bulk load process, during coupon allocation or at any point using an API call.

Coupons can be flagged as used or unused manually through API calls, or this process can be automated as part of campaigns. During checkout API calls, you can specify 0..n coupons and in your campaigns you can configure coupons to be a condition or a result. You could for instance specify that you only get a discount of $10.00 if you are using a coupon from coupon set X or you could configure the campaign to allocate a new random coupon from coupon set Y if a customer spends more than $100.00.

Customer segment definitions

In the Clutch Portal, you can define a customer segment and run this 'query’ on your customer base. You could for instance use this to split your customers into a low-value and high-value segment and set up Campaigns intended to migrate your customers from a low-value to a high-value segment.

API credentials

To access the JSON API, you need API credentials, being an API Key and a matching API Secret. You can manage your API Keys in your brand’s portal. By default an API Key / secret pair can be used to perform any operation within your brand.

Clutch will only store your API key, and a 'hash’ of your secret. Your actual API secret can only be shown once when it is generated in the Clutch Portal. For security reasons, Clutch will not keep a record of the plain-text version of your API secrets.

Request basics

The JSON API is based on Swagger.io version 1.2. This means that the entire API is described through JSON files, accepts JSON as input and will show JSON as output. The main Swagger.io api-docs file is located at https://api.clutch.com/api-docs, which links to the more detailed https://api.clutch.com/api-docs/merchant where all main API methods are documented.

There are many API client code-generators in existance for Swagger.io APIs, for more information see: http://swagger.io.

Endpoints

The base endpoint to be used for all API calles is:

- For stage: https://api-stage.clutch.com/merchant/

- For production: https://api.clutch.com/merchant/

Each API method is available by suffixing the base URL with the method name. For instance, the endpoint for search requests in production is: https://api.clutch.com/merchant/search.

All endpoints accept HTTP POST requests only.

Authentication

If you just open https://api.clutch.com/merchant/search in a browser, the request will fail, as it will be missing its authentication headers. By default, every API request must have at least 4 headers for authentication and identification:

- Header

Authorization, for HTTP Basic authentication using your API key and API secret as username and password. - Header

Brand, for your brand ID. This is needed for authentication, as your API key exists within your brand. - Header

Location, for your location ID. This is used to identify where the request is coming from. - Header

Terminal, for your terminal ID. This is used to identify which terminal / Point of Sale the request is coming from.

Authorization header

The Authorization header should have a value in the form: Basic dXNlcjpwYXNz. It starts with the string Basic followed by a base64-encoded API Key:API Secret. If your API Key is user and your API Secret is pass, you would have to base64-encode the string user:pass, resulting in dXNlcjpwYXNz.

For more information about HTTP Basic Authentication, see: http://www.w3.org/Protocols/HTTP/1.0/spec.html#BasicAA.

Authentication with Digital Signature

Generating an RSA-2048 key pair with openssl on Linux

# Generate a private key

openssl genrsa -out your-private-key.pem 2048

# Generate a public key

openssl rsa -in your-private-key.pem -outform PEM -pubout -out your-public-key.pem

Pre-signed content construction (signature version 1)

String preSignedContent = brandId + "\n" +

locationId + "\n" +

terminalId + "\n" +

signatureDateTimeStr + "\n" +

(employee == null ? "" : employee) + "\n" +

(externalTransactionId == null ? "" : externalTransactionId) + "\n" +

(customRequestId == null ? "" : customRequestId) + "\n" +

(note == null ? "" : note) + "\n" +

postBody;

Creating a signature from pre-signed content

//import java.nio.charset.StandardCharsets;

//import java.security.PrivateKey;

//import java.security.Signature;

//import java.util.Base64;

Signature privateSignature = Signature.getInstance("SHA256withRSA");

privateSignature.initSign(privateKey);

privateSignature.update(preSignedContent.getBytes(StandardCharsets.UTF_8));

byte[] signatureBytes = privateSignature.sign();

Strig signature = Base64.getEncoder().encodeToString(signatureBytes);

Instead of the Authorization header using HTTP Basic Authentication, it’s also possible to use a digital signature, using an RSA-2048 key pair and SHA256 with RSA.

To start using this method, first generate an RSA-2048 key pair. Keep your private key to yourself and send the public key as a PEM file to Clutch customer support. You will receive the API Key identifier that is assigned to your key pair.

The public key file should be in plain text and should start with -----BEGIN PUBLIC KEY-----. Each line should contain at most 64 characters (not including linebreaks) of base64 encoded data containing the modulus and exponent of your public key in X.509 SubjectPublicKeyInfo format. Note that this is different from an X.509 certificate. You can generate a public key in this format with OpenSSL from your private key with openssl rsa -in your-private-key.pem -outform PEM -pubout -out your-public-key.pem. Also see the full example in the right column.

To sign a request to the JSON API, do not send in the Authorization header, but instead add the following headers:

- Header

SignatureVersion, set this to1. This defines the format for the content being signed. This is currently always 1. - Header

SignatureDateTime, set this to the current date+time when placing the request in UTC, e.g. ‘2019-12-31 23:59:59’. Format isyyyy-MM-dd HH:mm:ss. Make sure your clock is in sync using an NTP service or similar, a maximum drift of 15 minutes is allowed. - Header

ApiKey, set this to the API Key identifier for the key pair you’re using to sign the request. - Header

Signature, specify the request signature here, base64 encoded.

To generate your signature, first construct the pre-signed content with the following items (one item per line):

- Brand ID

- Location ID

- Terminal ID

- Signature date+time (e.g.

2019-12-31 23:59:59), in UTC timezone - Employee ID (or empty string if not specified)

- External transaction ID (or empty string if not specified)

- Custom request ID (or empty string if not specified)

- Note header value (or empty string if not specified)

- Request JSON (can be multiple lines)

Use a single carriage return (0x0D) to split lines and don’t add any whitespaces that aren’t present in the actual headers or POST data.

With the pre-signed content and your private key, you can sign your request. Use a SHA256withRSA algorithm to create the signature with PKCS#1 v1.5, also known as RSASSA-PKCS1-v1_5. The signature header should be base64 encoded.

Additional headers

Besides the headers for authentication, you can optionally also send in the following headers:

- Header

employee, for your employee ID. This can be sent in to identify which employee should be tagged on the request. - Header

externalTransactionId, custom request identifier for logging. See Listing Requests. - Header

customRequestId, custom request deduplication identifier. See Idempotence. - Header

note, can contain a short reference or custom classification code for the request.

Note header

The note header does not have a constraint on uniqueness. If needed, every single API call could share the same note value. This value is not searchable or reportable, it will only show up in the requestLookup API call response.

Placing requests

Example request:

curl https://api-stage.clutch.com/merchant/search -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d '{"filters":{}}'

{"filters":{}}

/*

* NOTE: Not intended for usage in a customer's webbrowser,

* only intended for JS-based server software such as node.js.

*/

var apiKey = "";

var apiSecret = "";

var brandId = "";

var locationId = "";

var terminalId = "";

var beforeSend = function(request) {

request.setRequestHeader("Authorization", "Basic " + btoa(apiKey + ":" + apiSecret));

request.setRequestHeader("Brand", brandId);

request.setRequestHeader("Location", locationId);

request.setRequestHeader("Terminal", terminalId);

};

var successHandler = function(responseText) {

var responseObject = JSON.parse(responseText);

var requestRef = responseObject["requestRef"];

if(responseObject["success"]) {

// Request was successful

} else {

// Unexpected request problem, hostname might be incorrect.

}

};

var errorHandler = function(response) {

var responseObject = JSON.parse(response.responseText);

var requestRef = responseObject["requestRef"];

// Something went wrong

};

$.ajax({

"type": "POST",

"beforeSend": beforeSend,

"url": url,

"data": "{\"filters\":{}}",

"processData": false,

"success": successHandler,

"error": errorHandler

});

// Dependency from Maven: com.google.code.gson >> gson >> 2.3

// Dependency from Maven: org.apache.httpcomponents >> httpclient >> 4.3.5

// Dependency from Maven: commons-io >> commons-io >> 2.4

import java.util.HashMap;

import java.util.Map;

import org.apache.commons.codec.binary.Base64;

import org.apache.commons.io.IOUtils;

import org.apache.http.HttpResponse;

import org.apache.http.client.HttpClient;

import org.apache.http.client.methods.HttpPost;

import org.apache.http.entity.StringEntity;

import org.apache.http.impl.client.HttpClientBuilder;

import com.google.gson.Gson;

import com.google.gson.reflect.TypeToken;

/**

* Place a request to the Clutch JSON API.

* @param method The method name, e.g. search

* @param requestData Request data to be sent in as a Map structure, will automatically be turned into JSON.

* @returns Map structure with the parsed response from the server

* @throws Exception Will throw an exception in case of network errors, invalid JSON coming back or project setup issues

*/

private static Map<String, Object> runRequest(String method, Map<String, Object> requestData) throws Exception {

String apiKey = "";

String apiSecret = "";

String brandId = "";

String locationId = "";

String terminalId = "";

HttpClient client = HttpClientBuilder.create().build();

HttpPost postRequest = new HttpPost("https://api.clutch.com/merchant/" + method);

postRequest.setEntity(new StringEntity(new Gson().toJson(requestData)));

String authHeader = apiKey + ":" + apiSecret;

postRequest.addHeader("Authorization", "Basic " + new String(Base64.encodeBase64(authHeader.getBytes())));

postRequest.addHeader("Brand", brandId);

postRequest.addHeader("Location", locationId);

postRequest.addHeader("Terminal", terminalId);

HttpResponse response = client.execute(postRequest);

int statusCode = response.getStatusLine().getStatusCode();

String responseBody = IOUtils.toString(response.getEntity().getContent());

Map<String, Object> responseObj = new Gson().fromJson(responseBody, new TypeToken<Map<String, Object>>(){}.getType());

Boolean success = (Boolean) responseObj.get("success");

String requestRef = (String) responseObj.get("requestRef");

if(success != null && success) {

// Request was successful

} else {

// Request was not successful

}

return responseObj;

}

<?php

/**

* JSONSample.php

*

* execute: php JSONSample.php

*

*/

// Set credentials and variables

$url = "https://api-stage.clutch.com";

$port = "443";

$service = "/merchant/search";

$key = "";

$secret = "";

$cardNumber = "1234";

$brand = "";

$location = "";

$terminal = "";

// Create JSON array

$data = array(

"filters" => array(

"cardNumber" => $cardNumber

),

"returnFields" => array(

"balances" => true,

"customer" => true,

"isEnrolled" => true

)

);

// Create JSON string

$data_string = json_encode($data);

// Encode basic auth string

$basicAuth = base64_encode($key . ":" . $secret);

// Setup header array

$header = array(

"Content-Type: application/json",

"Content-Length: " . strlen($data_string),

"Authorization: Basic " . $basicAuth,

"brand: " . $brand,

"location: " . $location,

"terminal: " . $terminal

);

// Setup cURL

$ch = curl_init();

curl_setopt($ch, CURLOPT_CUSTOMREQUEST, "POST"); // Set Method

curl_setopt($ch, CURLOPT_POSTFIELDS, $data_string); // Set body request

curl_setopt($ch, CURLOPT_HTTPHEADER, $header); // Set header

curl_setopt($ch, CURLOPT_HTTPAUTH, CURLAUTH_BASIC); // Enable auth type

curl_setopt($ch, CURLOPT_SSL_VERIFYPEER, true); // Enable SSL verification

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true); // Enable return response

curl_setopt($ch, CURLOPT_URL, $url . $service); // Set the url

curl_setopt($ch, CURLOPT_PORT, $port); // Set the port

// Execute

$result = curl_exec($ch);

// Close cURL

curl_close($ch);

// Display results

echo "Raw JSON:\n{$result}\n\n";

echo "Parsed JSON:\n";

var_dump(json_decode($result, true));

?>

import scala.io._;

import dispatch._;

import scala.concurrent.Await

import play.api.libs.ws.WS

import play.api.libs.concurrent.Execution.Implicits._

import scala.concurrent.duration._

import scala.language.postfixOps

import play.api.libs.json.Json

object clutchJSONSearch {

def search : String = {

// Set credentials and variables

var urlStr = "https://api-stage.clutch.com"

var portStr = "443"

var serviceStr = "/merchant/search"

var keyStr = ""

var secretStr = ""

var cardNumberStr = ""

var brandStr = ""

var locationStr = ""

var terminalStr = ""

// Create JSON object

val jsonObj = Json.obj(

"filters" -> Json.obj(

"cardNumber" -> cardNumberStr

),

"returnFields" -> Json.obj(

"balances" -> true,

"customer" -> true,

"isEnrolled" -> true

)

)

// Create JSON string

val jsonStr = Json.stringify(jsonObj)

// Build URL

val fullUrl = urlStr + ":" + portStr + serviceStr

// Execute JSON call

val response = WS.url(fullUrl)

.withAuth(keyStr, secretStr, com.ning.http.client.Realm.AuthScheme.BASIC)

.withHeaders(("Content-type", "application/json"))

.withHeaders(("brand", brandStr))

.withHeaders(("location", locationStr))

.withHeaders(("terminal", terminalStr))

.post(jsonStr)

val resultFuture = response map { response =>

response.status match {

case 200 => Some(response.body)

case _ => None

}

}

// Wait for response

val result = Await.result(resultFuture, 5 seconds).getOrElse("Nothing Returned")

// Return result

return result

}

}

/**

* JSONSample.cs

*

* Compile: csc JSONSample.cs

* Execute: JSONSample

*

*/

using System;

using System.Collections.Generic;

using System.Linq;

using System.Web;

using System.Web.UI;

using System.Web.UI.WebControls;

using System.Net;

using System.IO;

using System.Text;

public class JSONSample

{

public static void Main()

{

// Set credentials and variables

string urlStr = "https://api-stage.clutch.com";

string portStr = "443";

string serviceStr = "/merchant/search";

string keyStr = "";

string secretStr = "";

string cardNumberStr = "1234";

string locationStr = "";

string terminalStr = "";

string brandStr = "";

string responseStr;

// Create JSON string

string jsonStr =

"{filters:"

+ "{cardNumber:\"" + cardNumberStr + "\"},"

+ "returnFields:"

+ "{balances:true,"

+ "customer:true,"

+ "isEnrolled:true}"

+ "}";

// Create full URL

string fullUrl = urlStr + ":" + portStr + serviceStr;

// Encode basic auth string

string auth = Convert.ToBase64String(Encoding.ASCII.GetBytes(keyStr + ":" + secretStr));

// Setup web service call

var httpWebRequest = (HttpWebRequest)WebRequest.Create(fullUrl);

httpWebRequest.ContentType = "application/json";

httpWebRequest.Accept = "*/*";

httpWebRequest.Method = "POST";

httpWebRequest.Headers.Add("Authorization", "Basic " + auth);

httpWebRequest.Headers.Add("location", locationStr);

httpWebRequest.Headers.Add("terminal", terminalStr);

httpWebRequest.Headers.Add("brand", brandStr);

httpWebRequest.ContentLength = jsonStr.Length;

// Send JSON string request

Stream dataStream = httpWebRequest.GetRequestStream();

dataStream.Write(Encoding.ASCII.GetBytes(jsonStr), 0, jsonStr.Length);

// Get response

var httpResponse = (HttpWebResponse)httpWebRequest.GetResponse();

// Read response string

using (var streamReader = new StreamReader(httpResponse.GetResponseStream()))

{

responseStr = streamReader.ReadToEnd();

}

// Display response

System.Console.WriteLine("\r\nRaw JSON Response:\r\n" + auth +"\r\n");

System.Console.WriteLine(responseStr);

}

}

To actually place a request, execute an HTTP POST request using the authentication / identification headers and a stringified JSON request object as post data, i.e. the request body. You can use one of the examples from the right to quickly get started. A good first test is to run a basic search call. Use the API method search and use the request body {"filters":{}}. If this returns a stringified JSON object containing "success": true, your authentication and identification works correctly.

Every request that you execute should respond with a JSON object, even if the request itself failed to execute. In the response will always be a "requestRef" field, which acts as a unique reference to the request.

For successful requests, you will always get back the status code 200. All other status codes indicate a problem has occurred, see Error Handling for more information.

Future Backwards Compatibility

When implementing an API client for the JSON API, one thing to keep in mind is future backwards compatibility. The JSON API adheres to the following versioning design principles:

- New request parameters that are added will always be optional

- Existing 'required’ response data is never removed

- Existing requests that do not include undocumented request fields will always continue to work, regardless of API changes

As a result, new API features will consist of:

- New API methods

- New optional request parameters on existing API request models

- New optional or required response parameters on existing API response models

Idempotence

Example error response when recycling a customRequestId:

{

"success": false,

"errorCode": 3,

"errorMessage": "This customRequestId has been used before.",

"requestRef": "10f4c34c-e4e5-4a11-b36f-5ca88289269c"

}

You can optionally add a customRequestId header to your HTTP request. For your brand, the customRequestId has to be unique, or else the JSON API will not execute the request but respond with error code 3 (Duplicate custom request ID).

You can safely execute the same request multiple times if it is using the same customRequestId, and it will only execute once. This can be useful in case of a network communication problem that leaves you unaware of the execution state of a request.

A good way to generate customRequestIds for your requests is by using UUIDv4s, as they are extremely unlikely to ever be the same, regardless of the machine they are generated on.

There is no limit to the size of your customRequestId, but for practical reasons it would be sensible to keep it roughly between 10 and 100 bytes.

Error Handling

Example error response:

{

"success": false,

"errorCode": 2,

"errorMessage": "Your card could not be found.",

"requestRef": "1455169c-a3c9-4896-9b45-3b72606e55dd"

}

Under normal circumstances you will never get any different response back from the JSON API server than a JSON structure containing at least a "success" field. If this success value is false, this indicate the JSON API ran into trouble while trying to execute your request.

In case the success field is false, there will always be 2 additional fields present in the response, errorCode and errorMessage. In your API code, you should only consider the errorCode, and ignore the errorMessage value. For a list of all error codes and their meaning, see the Error Codes section in this document. The errorMessage field will usually contain a descriptive message that can help a developer establish why a request did not process properly.

If the error code that is returned is 1 (Internal server error), please contact Clutch at asksupport@clutch.com to determine the root cause of the problem, including the requestRef field that you got back.

If you do not get a JSON object back in the response body, something unexpected has happened. Please verify the URL for the endpoint you are using is correct. If this is correct and you are still not getting back a JSON object in the response body, please contact asksupport@clutch.com and include the URL and exact date and time of the request.

Retry policy

If a request has failed to execute due to a network connectivity problem, you should retry the request. When retrying a request, it is important to ensure the same request never gets executed more than once, so for instance an issuance of $10 on a giftcard does not result in a total issuance of $20.

Make sure you are using a customRequestId (see Idempotence section for more information) if you are considering retrying a request. Optimally, retry a request using an exponential backoff algorithm:

- Place the request

- If the request is not successful, look at the cause, for instance look at the

"errorCode"field if there is one coming back). If this is an error that can be retried, wait 2 seconds and try again - If the request failed yet again, look at the cause of the error or errorCode again. If the errorCode is 3 (Duplicate custom request ID), the first request was successful anyway, stop retrying. Otherwise, if this is an error that can be retried, wait X seconds and try again. X is double the amount of seconds from the previous try.

- Repeat the process, at most 5-10 times per request.

Errors you could retry:

- Any network connectivity issue where no response is received

- Error code 1, i.e. Internal server errors in the JSON API (not necessarily HTTP status code 500, but

"errorCode": 1coming back in the JSON response). - Error code 4 (Concurrent card access).

- Error code 14 (Checkout in progress).

Employee identification

If you also want to specify which employee is executing a request, you can add the headers:

- Header

employee, the employee ID - Header

employeePassword, the password / passcode for the specified employee

Troubleshooting

If you have any problems with a request that you cannot figure out, please contact asksupport@clutch.com and include the "requestRef" value from the response(s) to the request(s) you are inquiring about.

If you do not have a "requestRef", please record the exact date and time of your request and the URL you were trying to hit. This can sometimes also help narrow down your request and find the problem.

Campaigns

Campaigns are used to execute certain business logic automatically when a (loyalty) card is being used or to automate promotions. You can configure your own campaigns through the Clutch Portal.

Most campaigns will be checkout-triggered, meaning they only apply to Checkout API calls. You could use campaigns to give 1 loyalty point per USD spent, give a 10% discount to loyalty customers, give 50% off every third hat purchased in your store, or really almost anything you can come up with.

Campaigns can also be set up to enhance your omni-channel interaction with a customer. You could for instance automatically send a thank you message to a customer’s email every time they make a big purchase in your store.

Structure

Within your brand you can have 0 to many campaigns. A campaign is a logical grouping of one or more campaign rules, which you can name for your convenience.

A campaign rule consists of:

- 0 or more conditions

- 0 or more results

If a campaign rule’s conditions are all met (or if there are no conditions), all of the results associated with that campaign rule will be executed.

Per campaign rule, you can specify what triggers its execution. Most of the time this will be checkout-triggered, meaning that every Checkout API call will trigger this rule. You can also have campaign rules that trigger on a customer’s birthday for instance. For more information about all the different triggers, see the Triggers section.

Within your brand, all campaign rules from all your campaigns will by default be considered for execution after every API request. If you want a campaign rule to only apply when cards from a specific program or card set are being used, you can add a condition to the campaign rule to make sure the card being used in the API request comes from that card set or program.

The results of a campaign rule are usually giving away balance or a discount, or sending out a notification.

Notifications

One of the possible results that you can add to campaign rules is a notification. A notification is an asynchronously executed message that gets passed to an external system, with the exception of ‘direct’ notifications. Direct notifications only apply to checkout-triggered campaign rules, they are messages that get sent back along with a Checkout API response.

The message body of a notification follows a standard template. In this template, you can use a number of variables that get converted into customer-specific values when the notification is generated. It can for instance include the current USD balance in an email that is sent to the customer, thankig them for their purchase and informing them of their new balance.

You can use the campaign manager to set up notification and add relevant variables. The variables will usually be in a format similar to this: {{balance balanceType="Currency" balanceCode="USD"}}.

Third party configuration

Before being able to send emails using campaign notifications, or any other form of external communication, you will have to configure the third party send medium settings. For emails, you can for instance configure your Sendgrid settings. Sendgrid is a third party that can act as an email gateway, see: [http://sendgrid.com]. You can configure your brand’s third party settings through the Portal as well. In the left menu, use Admin -> Credentials and pick the third party for which you want to configure your settings.

Triggers

Campaign rules can be triggered by different events. When a campaign rule is triggered, it does not mean that it will actually execute its results, it simply means that it will check the conditions and those match, the results will be executed.

Triggers:

- Checkout-triggered, when checkout API calls are placed.

- Account Update-triggered, when updateAccount API calls are placed.

- Date-triggered, when a certain event (to be specified) occurs, the campaign will automatically fire early in the morning. Can be useful to send customers a 'Happy Birthday’ email for instance.

- Social media response-triggered, when a social media event occurs, you can automate a response or balance issuance.

- Post processing-triggered, at the end of any API call.

When you set up a date-triggered campaign rule, there are usually 3 things to configure:

- Which event the campaign rule should be triggered on, e.g. customer’s birthday. This will start a general 'date-triggered’ execution of all campaign rules that are date-triggered, not specifically limited to this one campaign rule.

- A condition that makes sure the event you want to trigger on is happening today. If another campaign rule caused a 'date-triggered’ campaign execution for a card, you might not want this campaign rule to execute. E.g. if you are triggering on a customer’s birthday, also add a condition to check for the event 'customer birthday’.

- A throttle, i.e. the max occurrences and run settings for the campaign rule. Make sure that your campaign rule only runs once per 11 months for instance, to make sure someone could not abuse your campaign by for instance changing their birthday too often.

API Methods

Adding Personal Offers

{

"cardNumber": "ABC",

"offer": {

"discountType": "percentageDiscount",

"percentageDiscount": 10,

"skus": [

{

"sku": "SKU-123",

"includeChildProducts": true

}

],

"customId": 11223344,

"activationDate": "2029-12-21 23:59:59",

"expirationDate": "2030-01-01 23:59:59"

}

}

Example response:

{

"success": true,

"requestRef": "b5889a0f-3426-4381-84eb-6c2b7d79bdb9"

}

To add a personal offer to a card, use an AddPersonalOfferRequest object, the response will be an AddPersonalOfferResponse object.

In the request, you can choose one of the different discount types, for instance ‘percentageDiscount’.

You also have to specify the 'skus’ property for a new offer, to define which products get the discount. The offer will only be applied if all of these products are present in a checkout and can receive a discount, meaning those units of the product haven’t received another discount from another offer yet.

The same unit of quantity of a product can only receive up to 1 offer in a single checkout. All offers will be processed in the order in which they were added to the card, first added being processed first.

You can also specify 'qualifyingProducts’ on an offer. The offer will only execute if those products are present in the checkout. For that property, it doesn’t matter if those qualifying products already received a discount from another offer or not.

All offers get executed before campaign engine logic fires.

Offers can have an activation date in the future, if they should not be available immediately. All offers must have an expiration date on them, of at most one year into the future.

An offer can only match once per checkout. Optionally, you can specify the amount of times an offer can be used, meaning the offer can then be used in multiple checkouts, but still only once per checkout at most.

By default, all skus and qualifying products are considered to have a quantity of 1. If you want to discount more than 1 unit of quantity of a product, you can add it to the skus property multiple times. In this case, the offer will still only match if the quantity of that SKU in the checkout is at least as much as the amount of that SKU specified in the skus property.

Allocating Cards

To allocate a card or activate a specific card that has not been activated previously, use the allocate API method. This method takes an AllocateRequest model as input and returns an AllocateResponse model.

When allocating a card, you will receive the cardNumber and card’s pin in the response.

You can allocate a card from a card set, in which case we will pick a random available card, but you can also activate a specific card number, in which case you must already know the card number of a card in a card set’s ‘inventory’. Which type of allocation call is most optimal depends on your situation. If you have a physical card, you will usually want to physically pick one and specify the card number. For virtual cards, allocation from a card set is usually preferred.

Allocating from a card set

Example allocation request from a card set:

{

"cardSetId": "goodCardSet42"

}

Example response:

{

"success": true,

"requestRef": "af8f8adc-bca7-4b54-9518-b741c0520e40",

"cardNumber": "1234",

"pin": "4321"

}

To allocate a card from a card set, just specify the "cardSetId" field, indicating from which card set you want to allocate a card. If the card set does not have any available cards left in it, "errorCode": 16 (Card set depleted) will be returned. If this happens, contact asksupport@clutch.com. By default, this should never happen, as the Clutch support team actively monitors card sets to ensure they don’t just run out.

Common use cases

- You have a webshop selling giftcards and want to issue a new virtual giftcard.

- You want to select a new random card number and print it on something afterwards.

Activating a specific card

Example request to activate a specific card:

{

"cardNumber": "1234"

}

You can also allocate a card if you already know exactly which card number you want to use. In this case, just specify the "cardNumber" field in the request. If the request is successful, the card number and pin will be returned in the response, similar to an allocation from a card set.

Common use cases

- You have a stack of physical 'inventory’ cards in your brick and mortar store.

- You have a webshop selling giftcards and have to mail out pre-produced physical cards when they are ordered.

Allocating Coupons

Example random coupon allocation request:

{

"couponSetId": "your-coupon-set-id-here"

}

Example response:

{

"success": true,

"requestRef": "b5889a0f-3426-4381-84eb-6c2b7d79bdb9",

"couponId": "1234567890",

"customTags": ["Tag123", "10PERCENTOFF"],

"allowedWithCards": ["card-number-1"]

}

Alternative response, if the coupon had no data on it (yet):

{

"success": true,

"requestRef": "b5889a0f-3426-4381-84eb-6c2b7d79bdba",

"couponId": "1234567890"

}

To allocate a coupon or the mark a specific coupon as allocated / activated, use an AllocateCouponRequest object, the response will be an AllocateCouponRespone object.

The request to allocate a coupon will either have to specify a coupon set to allocate a coupon from, or a specific coupon ID to flag as allocated, you can’t specify both in the same request.

Once a coupon has been allocated it can never be unallocated. It can be marked as used or unused, and the custom tags / allowed with cards lists can be updated, but it can’t be removed or unallocated again.

Card History Lookup

Example card history request:

{

"cardNumber": "1234",

"beginDate": "2000-01-01 13:00:00",

"endDate": "2001-12-31 23:59:59"

}

Example response:

{

"success": true,

"requestRef": "de665b85-0392-4c70-a882-0adf44a4aa27",

"transactions": [

{

"transactionId": "5500112233",

"isLegacy": false,

"transactionTime": 1422460094976,

"location": "webStore123"

},

...

]

}

The cardHistory API method can be used to get a quick overview of the recent requests for a certain card. The request is defined using a CardHistoryRequest model and the response will be a CardHistoryResponse model.

The only required input for a cardHistory request is the "cardNumber" field. Optionally, you can also restrict the date range of the transactions of which you want to receive information.

The response of this API call will be a list of all matching transactions, specified in the "transactions" field of the response. This field will contain an array of HistoricTransaction models, one per transaction. The returned transactions will be in descending order of processed time, so the most recent transaction will show up first.

Each HistoricTransaction model will contain the field "isLegacy", which is true for transactions that were submitted using an API other than the JSON API.

Checkouts

A checkout is defined as a customer transaction where products are bought, whether a (loyalty) card was used or not. By recording checkouts for both (loyalty) card users and anonymous customers, the reports we can generate for you will become more enhanced.

For all related fields, see the CheckoutRequest and CheckoutResponse models.

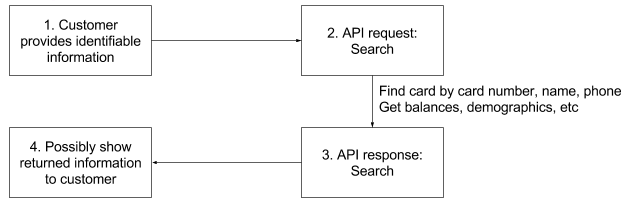

To get information about a customer’s card first, it can be useful to go through the following search flow:

In step 1, either scan / swipe a physical card to get its number, ask for the customer’s phone number or full name. The information from step 4 can contain balance data, which can be useful to offer as a potential payment method. See also Tracking payment methods and lift.

Once you have a card, or are completing a checkout for an anonymous customer, there are 3 different types of checkouts to choose from:

- Standalone checkouts

- Two-stage checkouts

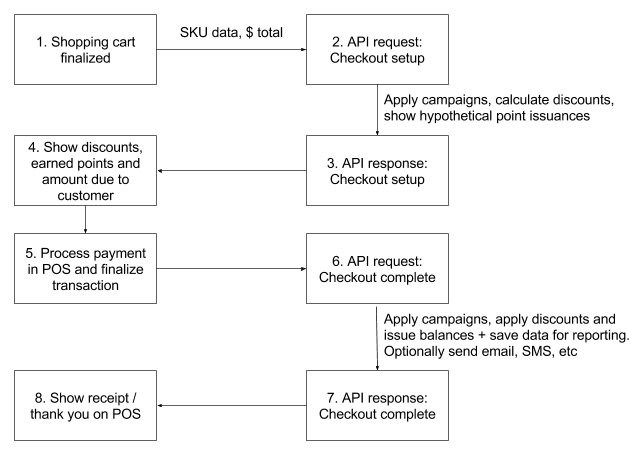

An example of the process with a two-stage checkout:

To make this locking, step 2 is flagged as a lock request and step 6 references the response from step 3.

It is possible to repeat the setup call multiple times, to alter the data that is sent in in step 1 and present new information to the customer in step 4. Nothing is finalized until step 5 / 6.

Which checkout type do you need?

Are you using a (loyalty) card for the checkout?

No? Use: Standalone checkouts.

Otherwise, do you have Campaigns set up that give discounts?

No? Use: Standalone checkouts.

Otherwise, are the discounts only caused by the products being purchased or the current checkout total?

Yes? Use: Non-locking two-stage checkouts.

No? Use: Locking two-stage checkouts, but consider Locking Alternatives.

Standalone checkout

Most basic standalone checkout, with the optional cardNumber field set:

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

"cardNumber": "1234",

"checkoutTotal": 100.50

}'

{

"cardNumber": "1234",

"checkoutTotal": 100.50

}

Standalone checkout example with SKUs being used to calculate the checkoutTotal (optional):

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

"cardNumber": "1234",

"products": [

{

"sku": "ABCD",

"amountPurchased": 5,

"unitPrice": 20.10

}

]

}'

{

"cardNumber": "1234",

"products": [

{

"sku": "ABCD",

"amountPurchased": 5,

"unitPrice": 20.10

}

]

}

Example checkout response (very basic):

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

"requestRef": "4ba2875f-17c4-4005-b95e-638a48984bfe",

"responseMessages": [],

"transactionId": "4500112233",

"checkoutTotalBeforeDiscount": 100.50,

"totalDiscount": 0,

"success": true,

"cardNumber": "1234"

}'

{

"requestRef": "4ba2875f-17c4-4005-b95e-638a48984bfe",

"responseMessages": [],

"transactionId": "4500112233",

"checkoutTotalBeforeDiscount": 100.50,

"totalDiscount": 0,

"success": true,

"cardNumber": "1234"

}

The standalone checkout is the simplest checkout call available. Just place one API call per checkout and at the end of the call all related balance and counter mutations will be final.

Optionally, a card number can be specified along with the request, to indicate that a (loyalty) card was used. The card number used in a checkout request should be the card on which you would want any loyalty points to be issued. Points are awarded based on the Campaigns set up for your brand. You can use cards from any one of your card sets in checkouts. If a checkout uses a card from a card set from a program that does not have Points set up as a value type, campaigns issuing Points will simply not issue anything. You can also restrict campaign rules to only work for certain card sets if you prefer.

As part of the checkout request, you can also send in SKU-level data. This is effectively a description of the contents of the customer’s cart for this checkout. It can contain the SKU of each product, the unit price and the quantity that was purchased.

The checkout total should always be sent in as part of the request for reporting purposes. If you are also sending in a full list of all SKUs, quantities and unit prices, you can choose to leave out the checkoutTotal parameter and we will calculate the checkout total based on the SKU-level data.

When to use

- If your brand does not have any Campaigns set up that give discounts, use a standalone checkout. First process the checkout and once payment is complete, place the API call.

When not to use

- If you have Campaigns set up to calculate discounts, don’t use standalone checkouts. You will first need to place an API call to figure out how much discount to give, then process the payment for that checkout and after that, place a second API call to indicate that payment is complete and the checkout can be finalized.

Two-stage checkout - Non-Locking

A simple checkout setup request, only difference with a standalone checkout is the isSetup value:

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

"cardNumber": "1234",

"checkoutTotal": 100.50,

"isSetup": true

}'

{

"cardNumber": "1234",

"checkoutTotal": 100.50,

"isSetup": true

}

The second stage in this approach is exactly the same as a standalone checkout.

A non-locking two-stage checkout consists of one ‘checkout setup’ API call to establish the discount and/or any balance changes that would happen, to get you enough information to start the payment process. Once payment is complete, place a standalone checkout API call to finalize the checkout.

When using this approach, it is very important that the discounts for a checkout cannot change between the first and second API call. It is called a 'non-locking’ checkout, as the checkout setup API call will not lock in the discount, but is simply expecting the discount to remain consistent by the design of your Campaigns.

When to use

- If you would like to know the balance mutations that would happen for a checkout before actually finalizing the checkout.

- If you have Campaigns set up that give a discount, but this discount is only based on the items being purchased or the current checkout total.

When not to use

- If you have Campaigns set up that give a discount based on anything other than the current cart content or checkout total. E.g. If the discount is based on the card’s balances, previous visits or purchases, customer enrollment status, customer birthday, previous amount spent, all-time total amount purchased of a certain product, do not use a non-locking two-stage checkout. In these cases, use a Locking two-stage checkout instead.

Two-stage checkout - Locking

A simple locking checkout setup request for a 600s (10 min) lock:

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

"cardNumber": "1234",

"checkoutTotal": 100.50,

"isSetup": true,

"lockSetupDuration": 600

}'

{

"cardNumber": "1234",

"checkoutTotal": 100.50,

"isSetup": true,

"lockSetupDuration": 600

}

The response is the same as with a standalone checkout.

An example checkout complete request for a locked setup (never contains SKU data or a checkout total):

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

"cardNumber": "1234",

"isSetup": false,

"relatedSetupTransactionId": "4500112233"

}'

{

"cardNumber": "1234",

"isSetup": false,

"relatedSetupTransactionId": "4500112233"

}

A checkout cancel request to cancel a checkout lock early:

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

"cardNumber": "1234",

"cancelSetup": true,

"relatedSetupTransactionId": "4500112233"

}'

{

"cardNumber": "1234",

"cancelSetup": true,

"relatedSetupTransactionId": "4500112233"

}

A simple checkout setup request that excludes USD balance from its lock:

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

"cardNumber": "1234",

"checkoutTotal": 100.50,

"isSetup": true,

"lockSetupDuration": 600,

"lockExcludedValueTypes": [

{

"balanceType": "Currency",

"balanceCode": "USD"

}

]

}'

{

"cardNumber": "1234",

"checkoutTotal": 100.50,

"isSetup": true,

"lockSetupDuration": 600,

"lockExcludedValueTypes": [

{

"balanceType": "Currency",

"balanceCode": "USD"

}

]

}

A locking two-stage checkout starts out with a locking checkout setup API call. Once this call is placed, the card becomes locked for the specified amount of time. Within this time you can choose to complete or cancel the checkout. Once the lock expires, it will automatically be cancelled and you will be unable to complete the checkout anymore without setting it up again.

Once the checkout has been set up, you will know the discounted checkout total, and you can start the payment process. Once payment is complete, you can run the checkout complete API call to finalize the transaction. You should not pass in the SKU data or checkout total in the checkout complete API call for a locking setup - just send in the card number, related setup transaction ID (from the response of the checkout setup API call) and the flag "isSetup": false.

The created 'lock’ on the card provides a guarantee that the checkout complete API call will do exactly what you expect it to, but as a result you will be unable to do anything else with the card between the checkout setup and complete API calls. Doing so could possibly change the campaign actions, so while the lock is active, the API prevents you from starting another checkout, updating balances on the card, enrolling the customer or modifying any card-related settings or fields.

To still use one or more value types in UpdateBalance API calls while the card is locked, you could set lockExcludedValueTypes on the locking checkout setup API call. This can be useful when the checkout is (partially) paid for using USD balance on a card, when no campaigns are set up to work with USD anyway.

Why locking checkouts?

If your campaigns calculate a discount / updated checkout total, you must know this discounted total (A) before the customer can start the payment process. If something on the card were to change during this payment process that (indirectly) changes the discount, the checkout total that is due could be higher or lower than A, meaning an incorrect amount was paid. To prevent this from happening, you can choose to have the checkout setup 'lock’ the card during the payment process.

When to use

- If you have Campaigns that give a discount based on anything on the card that could change, such as balances, enrollment status or card settings or fields. If you use discounts based on something other than the items being purchased or the current checkout total, this is the most optimal approach.

- If you want to know the balance mutations of all campaigns with absolute certainty before processing a checkout payment.

When not to use

- If you don’t want to 'lock’ the card during the payment process.

- If a checkout is initiated in a webstore and you don’t want to finalize the checkout / give the points until the items are shipped, you could potentially be locking the card for a very long time. If possible you could use a non-locking two-stage checkout, otherwise contact Clutch for a custom solution that works best in your situation.

- If you don’t have any campaigns set up that calculate discounts, or only calculate discounts based on current cart contents or current checkout total, a locking checkout is likely overcomplicated for your situation. Perhaps consider a non-locking two-stage checkout.

- For anonymous checkouts.

Errors while accessing a locked card

When trying to start a new checkout for a campaign that is locked, you will get an error message back. The response will have an error code 14 (checkout in progress). In addition, the response will contain a "checkoutSetupTransactionId": "5500112233" field, indicating the transaction ID of the current checkout setup for the used card.

Locking Alternatives

In some situations, it might not be possible or convenient to use a two-stage locking checkout. The base requirement for a two-stage checkout was: you need to know the discount before paying (one stage) and indicate that the checkout was complete afterwards (second stage). Also, the discount needs to remain consistent between the two stage, to ensure the total that was paid matches the total that is due (locking).

As a possible alternative, you could also choose to use 'cashback’ balance and use a non-locking two-stage checkout instead.

Example setup:

- You have a campaign rule that gives 1 point per $1 spent.

- You have another campaign rule that turns 100 points into 5 'dollars’ of cashback balance (custom.cashback).

- You have another campaign rule that gives $5 discount on any purchased hat.

- Because there are no discounts based on the card state, a two-stage non-locking checkout can be used.

- Every checkout setup API call is configured to return balances.

Example flow:

Step 1: New customer places a first checkout for $60, not buying hats

The first call (checkout setup) determines that the discount is $0, payment starts and once payment is complete, the second call is placed to flag the checkout as completed. During this second stage, 60 points get issued.

Step 2: Customer comes back and buys $70 worth of goods, including one hat

The first call determines that the discount is $5. Payment for $65 starts and once payment is complete, the second call is palced to complete the checkout. During this second stage, 65 points are added (reaching 60 + 65 = 125 points), then 100 points are removed and 5 cashback balance is issued. This results in 25 points and $5 in cashback balance on the card. Cashback balance is not Currency.USD, but Custom.cashback in this instance.

Step 3: Customer places another $50 checkout, not buying any hats

The first call determines that the discount is $0, and also returns the cashback balance 5. The amount due is determined to be $50 and the customer could be asked whether they want to use the cashback balance (or partially). If they do choose this option and for instance want to use 4 of this cashback balance, place a balance hold call, effectively reserving 4 of the 5 cashback balance.

At the POS, payment for $4 is now considered complete due to the reservation, leaving $46 to be paid (amount is calculated at the POS). Once this amount is paid as well, a checkout complete API call is placed (second stage). In the checkout complete, indicate the payment methods used, including $4 from a loyalty card, see: Tracking payment methods. Tracking payment methods is not required, but would improve the quality of generated reports.

Once the checkout is complete, do a hold redemption API call, see: balance holds. This will actually 'use’ the reservation on the balance and redeem it.

Expanding response data

Add these 2 fields to a checkout setup or standalone checkout request:

curl https://api-stage.clutch.com/merchant/checkout -X POST \

-u "API_KEY:API_SECRET" \

-H "brand: BRAND_ID" \

-H "location: LOCATION_ID" \

-H "terminal: TERMINAL_ID" \

-d \

'{

...

"returnBalances": true,

"returnBalanceMutations": true

}'

{

...

"returnBalances": true,

"returnBalanceMutations": true

}

The response will be expanded with these fields:

{

...

"balanceMutations": [

{

"campaignUUID": "7c206e9c-0896-4957-b7df-1a694e39ff69",

"campaignRuleUUID": "8b2f1bad-d31f-41c3-8760-5eddd2b6bc23",

"campaignResultUUID": "c7d615a7-3449-478a-a0d0-2bd1c118a8dd",

"amount": 1,

"isDiscount": false,

"balanceType": "Points"

}, {

"campaignUUID": "7c206e9c-0896-4957-b7df-1a694e39ff69",

"campaignRuleUUID": "8b2f1bad-d31f-41c3-8760-5eddd2b6bc23",

"campaignResultUUID": "96c0f317-0190-4999-8ed8-22ee553222e4",

"amount": 5,

"isDiscount": true,

"sku": "112233",

"skuAmount": 2,

"skuUnitDiscount": 2.50,

"skuUnitPrice": 10.00

}

],

"balances": [

{

"amount": 3,

"scale": 2,

"isHold": false,

"balanceType": "Points"

}

]

}

In some cases, you might want to know more details about the balance mutations that were triggered by a checkout, or get back the balances as they stand at the end of the finalized checkout request. You can add the fields "returnBalances": true and / or "returnBalanceMutations": true to any checkout API call to obtain this information, with the exception of checkout cancel API requests.

The returned balances will be the balances as they are or will be after the indicated balance mutations are applied. I.e. if you are using a checkout setup API call, the resulting balances will be purely hypothetical.

Every returned balance mutation will explain what caused the mutation. For mutations that were caused by campaigns, there will always be a campaign and campaign rule associated with the mutation and optionally a campaign result or campaign condition. The UUIDs for these objects are not visible in the Clutch Portal, but are available on request.

If a mutation object explains a discount, it can optionally also explain to which SKU of which unit price the mutation.

Example 1 - General discount

If your campaign is set up to give a $10 discount under certain conditions and this discount is given during a checkout, you will have one balanceMutation object coming back. On this object, no SKU references will be set, as the discount applies to the entire checkout and not to one SKU in particular.

Example 2 - 50% off every second hat

If your campaign is set up to give 50% off every second hat that is purchased and a customer purchases 5 hats, you will see 2 balanceMutations coming back. Each balanceMutation object would specify which SKU the discount applied to. In case you have multiple SKUs with different unit prices, you can figure out which SKU the discount applies to by looking at the skuUnitPrice field coming back as well. This field contains the unit price of the SKU before discounts.

In case of SKU-related discounts, each balanceMutation object will also specify the skuAmount, which is the quantity of the SKU that the discount applies to and a skuUnitDiscount which is the discount per unit of the SKU. By definition, skuAmount multiplied by skuUnitDiscount will be equal to the amount field.

Interactive Campaigns - Standardized options

A checkout response can contain standardized campaign choices. In this case, there will be a response structure in the availableOptions field in a checkout response containing CampaignOption model. This will only be returned in a checkout setup call.

In the returned options, there will be a number of fields:

- Choice group ID, if there are multiple options in the response, this determines grouping

- Option ID, a unique identifier for this option

- Option display value, a display value for this option that can be shown to the customer

- Max selected options count

If multiple options are returned with the same choice group ID, the customer can choose zero or more options from that group. The maximum amount that can be selected at once in such a group is determined by the smallest value of maxSelectedOptions for all returned availableOptions.

To send in a choice, specify campaignChoices in the checkout request object. Each choice should include the choiceGroupId and the selected optionId.

In case of locking two-stage checkouts, it is recommended to first call non-locking checkout setup to see which options are available and place a subsequent checkout setup call with the customer’s choices in that request. Campaign choices can be sent in during a locking checkout setup or a standalone checkout complete call, but not during a locking checkout complete call.

Interactive Campaigns - Custom key/values

Adding custom key/values to a checkout request:

{

...

"customKeyValues": [

{

"key": "yourKeyName",

"value": "someValue"

}, {

"key": "orTheSameKey",

"value": "someValue"

}, {

"key": "orTheSameKey",

"value": "someOtherValue"

}

]

}

In some use cases, you might want to have more control over the Campaigns from the API client code. In these cases, you can send in key/value pairs along with the checkout request and add a condition to a campaign rule to make sure it only fires if a certain custom key has one of a few pre-defined values.

You can send in multiple key/value pairs with the same key if you would like, using multiple CheckoutKeyValue objects in an array in the "customKeyValues" parameter of the checkout API call.

Example 1 - Discretionary campaign

You might have a discretionary campaign set up to give a 10% discount, where it is up to the cashier at the PoS to determine whether this campaign is used or not. It could for instance be used to give a small bonus to loyal customers who have been queueing for the cash register for a long time. With every request, you could send in a key/value object with key “runSpecialDiscount” and values “yes” or “no” - sending in a “no” value would be optional. In your campaign rule, you could set up a condition where the campaign only runs if the custom key “runSpecialDiscount” was set to “yes”.

You can optionally also expand the campaign rule to have multiple conditions and for instance only allow this special discount if both the custom key/value match and the card that was used comes from a certain card set.

Example 2 - Customer’s choice

The custom key/values also enable interaction between the campaigns and the customer. For example, a campaign rule can be set up to give a 10% discount on one hat and another campaign rule can be set up to give a 10% discount on one tie. But - the customer has to choose which of the 2 campaigns they want to use on their checkout. At the Point of Sale, the cashier would ask the customer which promotion they want to use. Based on this choice, the Point of Sale could call the checkout API with a custom key “customerChoice” set to either “hat” or “tie”.

In each of the 2 campaign rules, you can then set up a condition to ensure the rule only executes when the right custom key is sent in.

Example 3 - Promotions

Adding custom key/values for promo codes:

{

...

"customKeyValues": [

{

"key": "promoCode",

"value": "HATS123"

}, {

"key": "promoCode",

"value": "7TIES"

}

]

}

You might want to run a promotion where you print a promo code in a magazine, e.g. you have a webshop and put promo code “HATS123” in a magazine. When customers go to your webshop, they can enter one or more promo codes. If they add “HATS123”, they may get a 10% discount on the cheapest hat that is purchased. To prevent abuse, this only works at most once per customer and will not work for anonymous customers.

In this use case, you would pick some key to use for all your promos, for instance "promoCode". In your checkout requests, you can then add one key/value pair per promo code that is applied to the checkout using this key. If a customer wants to add 5 promo codes to a checkout, you would just send in 5 key/value pairs with the same key.

To actually make the promos work, create one campaign rule per promo. The campaign would have one condition of custom key/value, looking for value “HATS123” for key “promoCode” in this case. You can then add a result to give a 10% discount to the cheapest product from the category 'hats’ that was present in the checkout.

To prevent abuse, set the 'max occurrences’ of the campaign rule to at most 1 in total per customer (or for instance per week if you prefer). This will make sure that that particular campaign rule does not get exectued more than once per customer, and will not work for anonymous customers.

You can also add a start/end date to the campaign rule, to ensure that it for instance only works during the first month after this promo code appeared in the magazine. You could of course also just remove the campaign rule for that particular promotion after a month if you would prefer.

Interactive Campaigns - Augmenting API responses

Example checkout response section with direct notifications:

{

...

"responseMessages": [

"Only 5 points to your next reward!",

"You're missing out! Add a tie to your purchase to receive a 10% discount on the entire checkout, today only!"

]

}

To make Campaigns more interactive, you can allow them to send messages back in the checkout API responses. This can be useful if you want to show a richer output on your Point of Sale for the customer, or to integrate more closely with your own systems.

In any campaign, you can set up notifications as campaign rule results. If the campaign rule’s condition match, all its results will be executed, including any notifications that have been set up as rule results. A notification can use many channels, it could be an email, a tweet or a 'direct’ notification. Direct notifications are messages that are sent out as part of the CheckoutResponse as the array of strings "responseMessages".

For two-stage checkouts, all notifications for your campaigns are not actually sent out until the checkout is finalized, to ensure that for instance emails to your customers are not sent until the checkout is actually finalized. Direct notifications are an exception to this pattern, they will be included in the CheckoutResponse for both checkout setup and checkout complete API calls.

Example 1 - Configure customer-facing messages in your campaign

As shown in the example response on the right, perhaps you want to set up a campaign to incentize a customer to buy a certain product of which you have excess units in stock. This works ideally with either two-stage checkout process, as you can first place a checkout setup API call to get all the customer messages and incentize them to add a product to the order before completing the checkout.

In this case the API flow would be:

- Place a checkout setup API call, receive customer messages back.

- Show messages to the customer, customer might add another product to the checkout.

- Cancel the first checkout and place a new checkout setup call.

- Continue as usual

Example 2 - Integrate with non-Clutch results or systems

Another possibility with direct notifications is to send out "responseMessages" entries that are meant to be processed by your API client code. E.g. a campaign could be set up to add an entry to a call list for any customer purchasing over $1000 in merchandise. The Clutch campaign does not have the capability to place phonecalls, so instead you could have a result of responseMessage “automatedAction:call” or any message that is easy for your API client code to process. Your API client code could then send a notification to a customer service employee requesting to call your new high-value customer.

Receipt Printing

Example response with receipt messages:

{

...

"responseObjects": [

{

"receiptMessage": true,

"message": "This should be printed on the receipt"

}, {

"receiptMessage": false,

"message": "This should not be printed on the receipt"

}

]

}